What a formal China Outbound Tourism survey won’t tell you.

Guest Writers are not employed, compensated or governed by TDM, opinions and statements are from the specific writer directly

To set the stage right, my company respects surveys. We actually did many surveys ourselves and came up with Young Chinese Travelers’ Journey, 9+1 Chinese Travel KOLs Opinions amid & post COVID, etc., and they were widely used as references in the industry.

However, survey results will only show true and meaningful findings under normal circumstances i.e. no particular stand or mandate from the Chinese government. Like many years ago when the Chinese government discouraged and even banned group tours to South Korea, most Mainland Chinese surveyed will just tell you they have no interest in South Korea but in fact they may be planning to travel as FITs to South Korea soon. These survey results were literally “political-correct” statements.

And sometimes, the interpretation of the survey results will want to draw some political-correct conclusions. But if you challenge and think deeper, maybe validate with other sources, you may come up with a different perspective.

Now, I am writing this controversial piece as I had seen some survey results on China Outbound Tourism recently and the results or the conclusions do not match with my observations. So, if you decide to read on, this is an opinion piece, my opinions basically.

- Anita disagrees: Mainland Chinese will continue domestic travel (instead of outbound travel) post COVID since they have been traveling domestically during the pandemic and discovered its beauty.

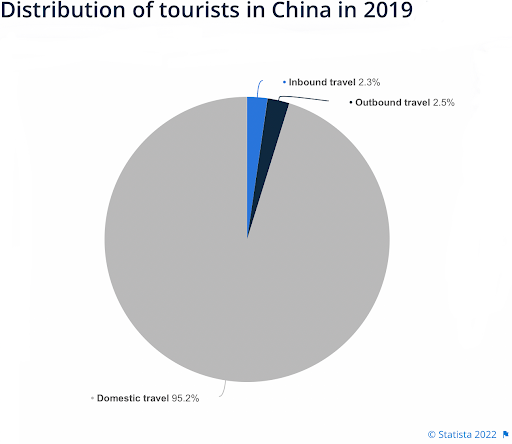

Anita’s opinion: First of all, if you do not already know, most Chinese can only travel domestically and cannot travel overseas say about 15 years ago. Even up till today, only around 10% of the entire Chinese population got passports to travel. In 2019 (pre COVID), 95% of the trips made by Chinese were all domestic travel, only 2.5% of Chinese tourists traveled outside China to other countries. (Source: Statista)

Yet, this 2.5% China outbound business already named China as the #1 biggest outbound source market in the world in 2019. Hence, in my opinion, travel overseas is always a privilege to Mainland Chinese and outbound travel can never be replaced by domestic travel. The reason why Chinese may say they will continue domestic travel in surveys was because Chinese government TOLD mainland Chinese to stop all non-essential overseas travel so it is not political-correct for them to say they will jump on the plane to go overseas.

Informally, I have talked to many Chinese in Mainland China in private and some indicated they are planning to leave for a longer holiday outside China whereas some had left already especially after the Shanghai lockdown. The “issue” that may hold them back was if you have an expired passport, then you cannot possibly travel as it seems the Chinese government has stopped (or slowed down drastically) in the passport renewal process. But if they have a choice, they still prefer overseas travel than domestic travel. (Source: private)

- Anita disagrees: Sanya is now so well-developed as the duty-free shopping port so Chinese no longer needs to travel overseas and Sanya will replace many overseas travel destinations.

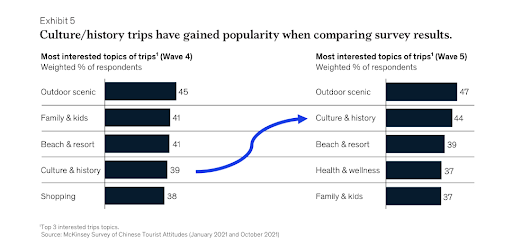

Anita’s opinion: No doubt Sanya is developed as a great destination for Chinese in many aspects. However, in recent years, Chinese FITs have shifted their priorities on overseas trips in which shopping is not even on the top 5. I do agree if Chinese want to go shopping, they can go to Sanya and not overseas. But my point is, Chinese do not travel overseas just for shopping now so Sanya cannot replace international travel.

From the recent survey from McKinsey (updated October 2021), you can see the shift of Chinese interested topics. I am especially interested to see that culture / history trips are moving up. This is a clear indication to me that there is a deep-down urge of the Chinese FITs to want to experience the different cultures and histories of other countries and why domestic destination like Sanya cannot replace China outbound tourism.

III. Anita disagrees: Chinese will prefer to travel to countries with lower COVID cases and will choose hideaway properties to stay and do things in small groups only.

Anita’s opinion: (Sorry, I said the above in 2020 too). Anyway, here I am not going to spin around vaccination or the characteristics of Omicron contributing to how everyone else in the world is getting back to normal so China should, etc. In fact, in China, since it is always (& still) under the dynamic zero-COVID strategy, it really makes Chinese “scared” of COVID. And it is understandable why they are extra cautious in their future travel plans.

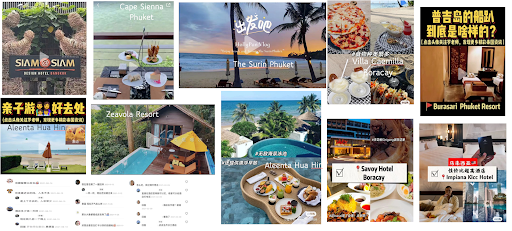

However, this is going to change quickly especially when now they see overseas Chinese can travel easily and these people are having so much fun. We actually noticed this shift lately based on the positive sentiments on our social media accounts (e.g. Little Red Book and Weibo) as well as the KOC (key opinion customers) campaigns we ran for our Asian hotel clients not long ago.

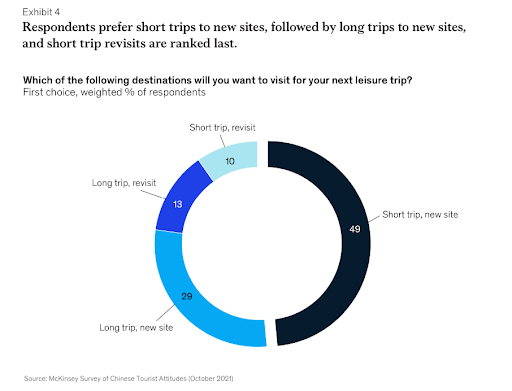

From our experiences, though Chinese will not express explicitly their plans to travel overseas, their actions did tell us so. They begin to collect content from social media (far more than 2020 and 2021), engage with practical questions and follow overseas accounts again. And we noticed they are interested to go anywhere, staying in luxury and boutique hotels (but not necessarily hideaway properties so to speak) and joining meaningful activities whether in big or small groups. Similar to the findings by McKinsey, whether short-haul or long-haul, Chinese are interested to explore new places and new things to do.

To always end on a positive note, even the dynamic zero-COVID policy remains unchanged in China, we have seen positive signs that China is moving towards opening up outbound travel. First. China now allows international flights to arrive directly to Beijing (and not via nearby cities any more). Besides, we have also seen increase in international flights capacity countrywide. Last but not the least, many strict quarantine rules in China say 14+7 have been relaxed to 7+3, etc. These are all positive signs. I hope this article on my interpretation of some survey results will give you a different but wider perspective to better prepare on the rebound of the China Outbound Tourism.

Tags: Chinese Tourists; Chinese Travelers; Chinese Outbound Tourism; COVID-19; Post COVID-19 trends; Destination Marketing; Hospitality Marketing; Recovery Timeline; Tourism Rebound; China Marketing

Compass Edge is a company offering online solutions to independent hotels. It is a niche service provider offering cost-effective branding solutions for overseas hotels to establish an online presence for the booming Chinese FIT market. It can also provide customers with an Internet Booking Engine, meta-search integration, GDS distribution and Channel Manager in its portfolio of solutions.

This article was written by Anita Chan, CEO of Compass Edge. Anita has extensive travel industry experience, and has worked all over the world with leading companies such as Four Seasons Hotels and Delta Hotels, as well as in corporate offices and technology service providers. Before joining Compass Edge, Anita worked as Regional Director for a leading OTA in Asia, as Global VP Marketing for a public company in Canada, VP for a leading digital agency, and as VP Asia Pacific for Small Luxury Hotels of the World.

Comments are closed.