This article is a redacted form of a longer post by Altexsoft.

According to the study by Fuel and Flip.to, travellers visit 4.4 unique websites to book their holidays. These sites tend to be ‘all-in-one-place’ platforms, done through combining data from numerous sources through APIs or Application Programming Interfaces.

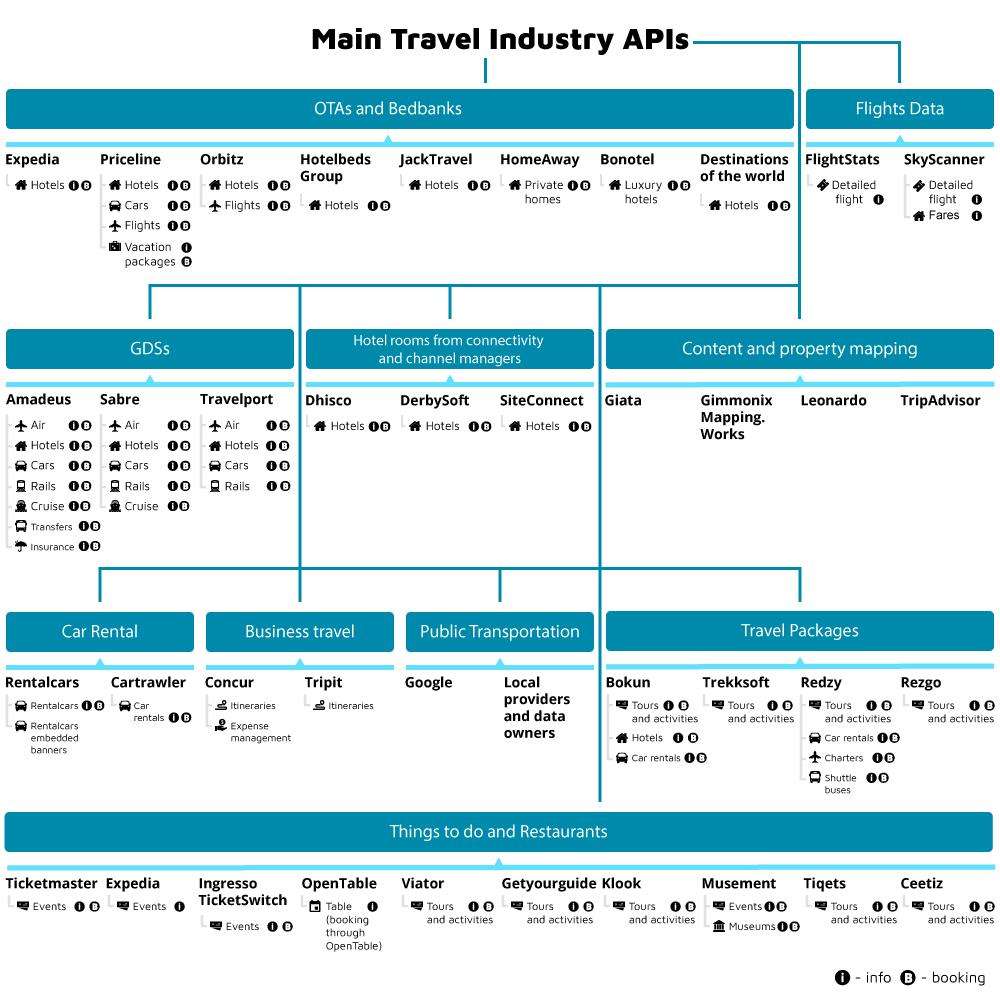

If you run a hotel business, you can let your customers rent a car straight from your website by integrating your room reservation engine with available local car rental providers. This may put a commission in your pocket or just make your customer’s life easier by eliminating time browsing the web to rent a car. These are the most important types of APIs used to unify travel industry features and information:

- Comprehensive booking and reservation coverage: GDS APIs

- Flights data: routes, airfares, delays, ratings

- Hotel room reservation APIs from OTAs and bedbanks

- Hotel rooms reservation APIs from connectivity and channel managers

- Content and property mapping

- Car rental

- Business travel

- Reviews and ratings

- Public transportation

- Things to do, tours, attractions, and restaurants

- Packaged travel, tour, and attraction APIs from channel managers

GDS systems provide the widest data coverage, while you can find more task-specific APIs from niche companies

1. Global distribution system (GDS) APIs for booking and reservations

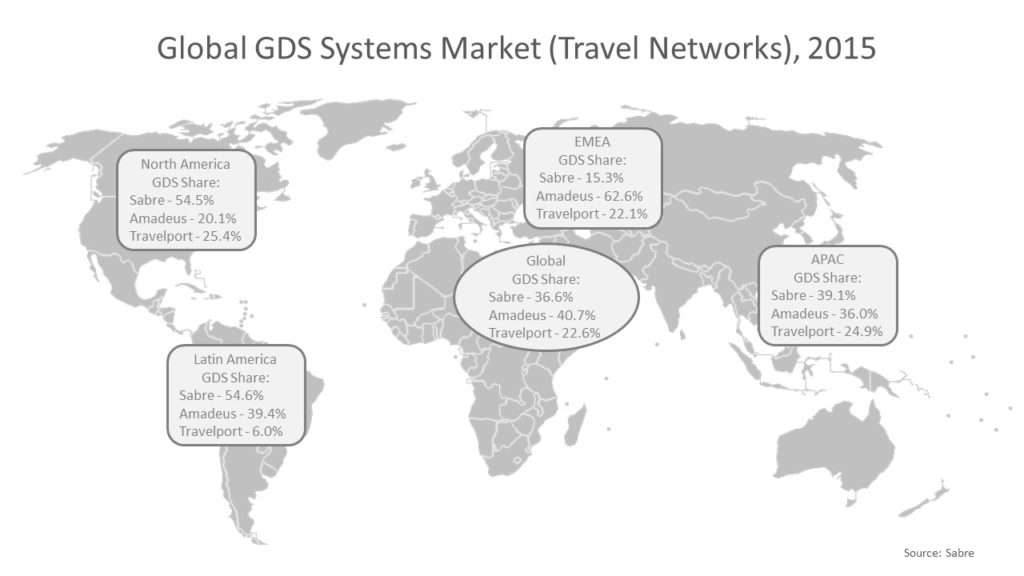

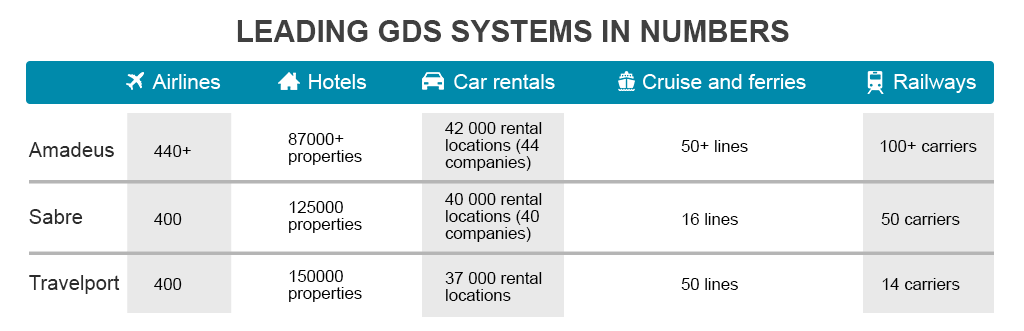

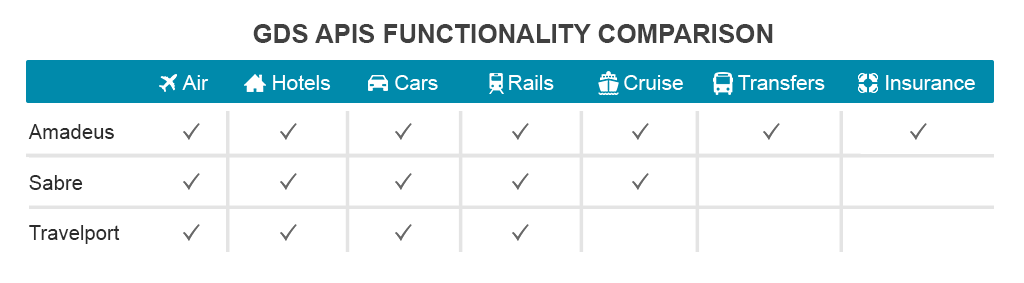

AGDS collects and consolidates travel data from a wide spectrum of service providers and allow agents to reserve: airplane seats; hotel rooms; car rentals; cruise lines and ferries; and railways. There are three main GDS players on the market: Amadeus, Sabre, and Travelport. According to Sabre, these three cover 99,9 percent of the GDS market share.

GDS market shares differ across regions

Depending on particular APIs you are going to use, you may consider their industry coverage

Amadeus

Amadeus has two sets of APIs: Amadeus Web Services, the main set of APIs that covers the above products, and the Travel Innovation Sandbox, which is for students, individuals, and early startups that are at the prototyping and experimentation stage.

Sabre APIs cover pretty much the same set of functions but has a has more detailed APIs division, including such categories as profiles, trip and session management, and utilities.

The Travelport Universal API unites three GDS systems: Apollo, Worldspan, and Galileo.

Currently, Amadeus provides the largest API variety

The challenge of choosing the best GDS API has been around for years. While there are technical differences that may tip the scales, market coverage also plays an important role. Common practice is to use the most popular GDS for a region as this means slightly better seating options and pricing from carriers. From this point of view, Amadeus would be the best fit for targeting Europe, while Sabre suits travel in North America.

GDSs provide general data for booking and reservations. However, if you need specific solutions like hotel booking or car rentals, it’s worth looking at dedicated products.

2. Flights Data

Skyscanner APIs. GDSs send general flight data, but some providers can reach more precise fare returns than GDSs for lower cost. Skyscanner API doesn’t have subscription or query-driven payments. Instead, Skyscanner suggests its API users enroll in an affiliate program. The service then charges a commission based on your traffic and market proportion. While Skyscanner also provides car rental and hotel APIs, its strong point is flight fare search. It comes in two main versions:

Browse Flight Prices. This set ships cached prices for an aggregated variety of origin-destination and time-frame queries, meaning that you can set up a flex search using these APIs. The drawback is the cache doesn’t update frequently for less popular route and date combinations. If the prices change, sometimes your users won’t be able to see updated info.

Live Flight Prices. The live pricing API, on the other hand, returns exact fares for any given moment. But you must query the exact time and route to retrieve prices. This feature comes in handy whenever you need to compare prices for specific dates and routes.

3. Hotel Room Reservation APIs

There are two main players dictating the rules of the OTAs market: the Priceline group (Booking.com, Kayak, Momondo, etc.) and Expedia (Expedia.com, Hotel.com, Trivago, etc.) If you mostly look at hotel booking, it’s worth working with these two players. Not all APIs are publicly available and you’ll have to become their partner to fully leverage their capacities.

These two giants both have their partnership networks. Expedia Partner Central is aimed at hotels and Expedia Affiliate Network at online travel agencies and other travel software providers. Priceline Partner Network supports APIs for smaller travel agencies and travel applications owners.

Expedia provides a set of public APIs that mainly have informational search capacities and sometimes duplicate features available in EAN and Partner Central solutions. Priceline, on the other hand, focuses on online travel agencies only or any other travel tech suppliers that help their customer find travel related data. Currently, the Priceline API allows for retrieving and booking hotels, cars for rent, flights and vacation packages.

4. Hotel rooms from connectivity and channel managers

If you want your hotel to be visible in multiple OTA listings and to make your property data displayed on these OTAs correctly, you must comply with each individual API requirement. And as the number of platforms you want to be presented on grows, so does the amount of engineering effort spent on integration. Instead of manually making all connections work, you can apply to these mediator services:

Dhisco is a global connectivity provider that enables one-to-many distribution of hotel rooms connecting main OTAs, travel agencies, metasearch engines, and GDSs with hotel chains. Currently, the service has access to over 100,000 properties.

DerbySoft ships its connectivity solutions in multiple bundles: Click connection services for metasearch engines and hoteliers; and Build and Go connectivity platforms, that respectively establish links between the largest OTAs and the largest hotel groups, or between midsize suppliers, regional businesses, and startup distributors.

SiteMinder is one of the largest channel management providers for hotels. It allows hoteliers to connect their properties to the leading OTAs and GDSs via the cloud interface, increase direct bookings, and analyze performance. The SiteConnect API mostly addresses OTAs and other end-user providers; it provides room retrieval (available rooms and rates), inventory (rooms and dates) and reservations.

5. Content and Property Mapping APIs

Destination research is what defines the booking experience for many travelers. They want to know how their accommodation will look, what the surroundings are, and they may want to compare offers from different tour operators. Content APIs will help address this demand:

GIATA API. GIATA connects to about 500 content providers like tour operators and travel agency chains. Their XML interface addresses various content searches, from images and videos to comparing tour operators and their offers. Also, the GIATA interface allows for mapping properties on all levels.

Gimmonix Mapping.Works APIs. Mapping.Works is a set of APIs that help both property owners and OTAs map their inventories. The provider employs ML-based text analysis to extract meaning from various inventory descriptions and operates on two levels of mapping: hotel mapping and room mapping.

Leonardo APIs. Leonardo connects media content in over 100,000 properties globally. The company bundles its services both for OTAs and hotels allowing these groups of travel players to better manage media data.

TripAdvisor Content API. The API allows for retrieving information on accommodation, restaurants, and attractions, including such details as location IDs, property names, addresses, longitude and latitude.

6. Car Rentals

Multiple players on the market are bundling their services with car rentals as GDS systems and main OTAs already support car rentals. The players include:

Rentalcars.com is currently the largest provider in the sphere owned by Priceline. If you look at embedding car rental support only into your website, it’s worth considering their services as Rentalcars works across about 48,000 locations around the world in 163 countries.

CarTrawler is a fully B2B service that connects travel agents, travel retailers (OTAs), and international airlines with local car rental suppliers. Currently, the company operates in 43,500 locations in 190 countries.

7. Business travel

The main player in the business travel market is Concur. The company offers a cloud-based travel management platform that helps businesses manage trips, track travel expenses, book flight seats, hotel rooms, and rent cars.

Concur strives to engage the development community in building and incorporating their applications with Concur business profiles. How does this work? Concur API aims at two main use cases, itinerary support for business travelers and expense management.

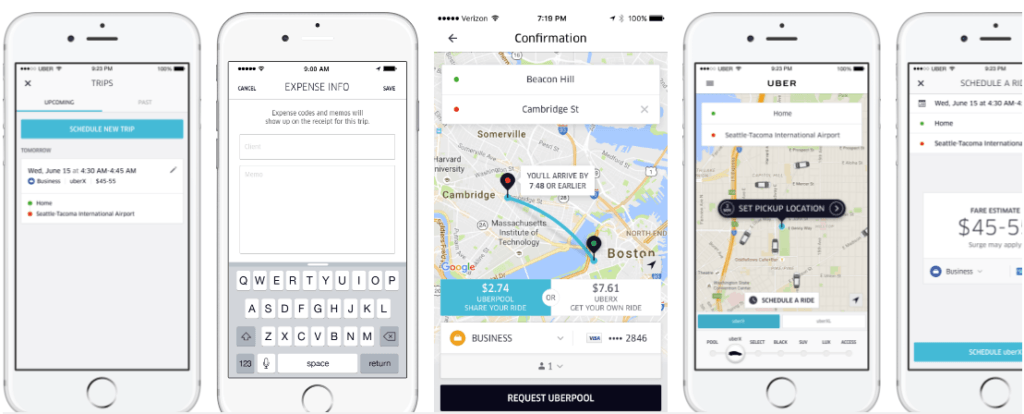

Concur integration into the Uber app. Image credit: Uber

The Tripit API allows for embedding an “Add to Tripit” link on the travel booking confirmation page of your website or adding Tripit travel plans to a website or applications, enabling users to configure itineraries through Tripit without leaving your resource.

8. Reviews and ratings

The TripAdvisor Content API allows businesses to incorporate the main content types that the service collects from its users and update them in real time. TripAdvisor works with accommodations, restaurants, and attractions providing the following types of content through their API:

Location ID, Name and address; Latitude and longitude; Reading and creating reviews (basically, users will be able to leave reviews through your website or app); Ratings and awards (TripAdvisor ranking, subratings, the number of reviews the rating is based on, etc.), Categories and subcategories (price level, accommodation category, attraction type, restaurants, and cuisine).

9. Public transportation

Embedding Google Maps is quite common today. The Google APIs are open, well-documented, and widely used across industries. However, Google also provides APIs for tracking public transport routes and schedules: the General Transit Feed Specification (GTFS) and GTFS Realtime.

Local operators such as Dutch Railways and French National Railways, also provide APIs that provide updates in real time about disruptions and engineering work.

10. Things to Do and Restaurants

There are two main sources for finding attractions and things to do for your customers. These are 1) local services like London Theatre API and 2) larger vendors that aggregate and share data combined with ticket purchasing support.

Ticketmaster APIs. Ticketmaster is the largest events booking provider on the market. It covers concerts, festivals, plays, and sports events across the United States, Canada, Mexico, Australia, New Zealand, the United Kingdom, Ireland, other European countries, and more. The service claims to reach about 230, 000 events worldwide.

Back in 2016, it released multiple APIs to let third parties embed the Ticketmaster events search and booking support into their products: the Discovery API and Commerce API only for information or the Partner API to allow your customers to directly book from your resource through the affiliate programme.

Various other examples include Ingresso TicketSwitch API, used by Amazon Tickets; Expedia Things to Do; Viator APIs with about 60,000 activities and tours; Getyourguide with 32,000 activities in more than 7,000 destinations; Klook which focuses on Asia; Musement Transactional API with 5,000 deals in 300 cities in 60 countries around the world; and OpenTable Affiliate Program for restuarant bookings.

11. Packaged travel and T&A APIs from channel managers

Like hotels, T&A supply isn’t limited to what OTAs suggest. While their offer may be enough, there are also niche companies that specialize in connecting travel agents with suppliers, suggesting interfaces, APIs, or both options to configure and source tours.

On top of that, these services allow for configuring custom travel packages that include T&A, accommodation, and even car rentals: Bokun API is a tourism reseller platform that partly operates as a marketplace where local travel providers and property owners connect with OTAs and agents. The Trekksoft API. Trekksoft focuses solely on tours and activities; Redzy API, a T&A service for channel management, and the Rezgo API.