Shiji Global Distribution Chart 2024 indicates an industry in motion where adaptability and innovation are crucial

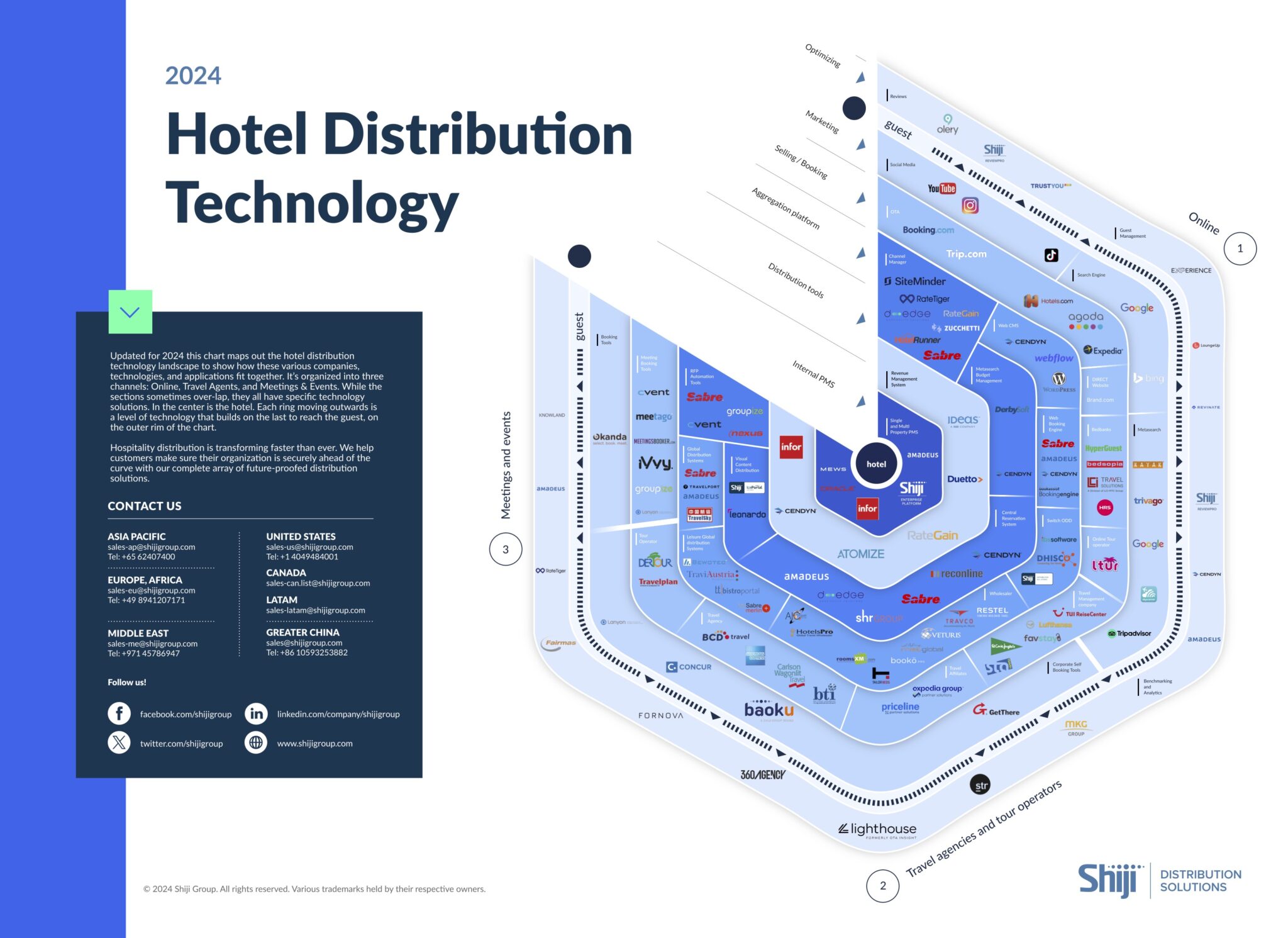

The Shiji Global Distribution Chart is the annual infographic, backed by popular demand, that they put together to show the entire hospitality tech distribution landscape. Hoteliers find this extremely useful because it helps them visualize how the various techs connect with hotels, guests, and each other.

Characterised by ongoing acquisitions, strategic brand movements, and the introduction of new segments, it is a busy time in hotel tech. They have analysed the chart compared to it’s previous version to see what are the trends and directions shaping hotel technology’s future. From strategic acquisitions enhancing customer relationship solutions to the recognition of crucial roles played by Travel Affiliates and Bedbanks, the industry is moving towards a convergence of services and experiences. This analysis considers the intricacies of these changes, shedding light on the trends, shifts, and future directions of the hospitality technology sector.

Key Takeaways

- Continued Acquisitions: The years 2022 to 2024 have seen significant consolidation in the hotel distribution technology sector.

- Brand Evolutions: The industry is actively adapting to changing market demands, which is part of consolidation.

- Specialised Segments: Sections for Travel Affiliates and Bedbanks in the 2024 infographic acknowledge their industry roles.

- Integrated and Personalized Solutions: The industry is increasingly leaning towards integrated solutions that offer personalised guest experiences.

- Openness and Interoperability: There remains a crucial need for open APIs and interoperable systems.

Consolidation Continues

We saw a continued trend of industry aggregation, highlighted by strategic mergers and acquisitions such as Cendyn expanding its reach by acquiring WIHP and Pushtech, enhancing its customer relationship and digital marketing solutions. Similarly, SHR Group acquired AVVIO and executing a thorough rebrand of the group and their products, MEWS acquired NOMI and Canadian PMS, HOTELLO.

Rategain’s purchase of ADARA highlights the critical role that travel data now has in industry solutions, and SABRE’s acquisition of TECHSEMBLEY focuses on their intent to expand and accelerate their hospitality retailing solutions.

These acquisitions reflect a strategic alignment towards ongoing growth and creating robust, all-encompassing platforms. The moves illustrate a shift towards one-stop-shop solutions. As a pioneer of the consolidation of the hotel tech industry, Shiji executives have a front row seat on the potential advantages and work that it requires.

Kevin King, CEO Shiji International said: “Industry consolidation is a key factor in advancing digital transformation within the hospitality sector. The development of new products is essential, and these products are most effective when integrated into a comprehensive suite of solutions. At Shiji, we have over a decade of experience in this area. It’s important to understand, however, that the process of change doesn’t stop at the point of acquisition. There’s a significant amount of ongoing work required, involving both the customers and product teams. This journey, though challenging, opens up a world of new opportunities for everyone involved in the industry.”

Strategic Brand Movements

Shiji’s PMS, Shiji Enterprise Solutions is added to 2024’s infographic, culminating the long-term strategy to provide best-of-breed solutions for the industry based on the acquisitions made over the last several years, a precursor to the current aggregation phase of the industry. The brand formerly known as OTA Insight felt 2023 was the right time for new branding and is now Lighthouse. These shifts underscore an industry responsive to evolving market demands, highlighting the adaptability of these companies in a rapidly advancing technological landscape.

New Sections

The 2024 infographic introduces new sections; they carved out individual Travel Affiliates and Bedbanks sections under the Selling and Booking ring.

The bedbanks section of the chart was added this year, as well as a section for travel affiliates.

Travel Affiliates recognises the crucial roles of these companies in forging affiliate programs to promote and sell travel-related services such as hotels, flights, tours, and car rentals. This model is crucial in the hospitality industry as it extends the reach of hotels and travel services to a broader audience through various channels, tapping into the affiliate’s network and influence. It’s a cost-effective marketing strategy that aligns with the digital transformation of the travel industry.

Bedbanks remain significant as they are important intermediaries between hotels and travel agencies or OTAs. By managing extensive inventories of hotel rooms and offering them to travel sellers, Bedbanks enable hotels to distribute their rooms across a broader market efficiently. This results in better utilisation of inventory, more competitive pricing, and a wider reach in both the leisure and corporate travel markets.

These additions reflect an understanding of the nuanced and interconnected elements of the hospitality industry’s selling and booking ecosystem. Recognising and leveraging these specialised segments is key for industry players to maximise their reach and revenue, especially in the increasingly complex and competitive world of travel and hospitality.

Future Trajectory

The industry’s trajectory is one of convergence—of services, platforms, and experiences. The rise of integrated solutions indicates a future where data and personalised guest experiences become central.

Note, you can create your own chart visualizing your distribution technology using our free template available as a Powerpoint document. We have included a set of logos. But you will probably need to find more based on your unique set-up.

The Big Picture

Mergers and acquisitions in the hotel technology sector have continued in 2023, emphasising the formation of more resource-rich industry players. This consolidation is not just a market movement; it’s a strategic step towards enhancing innovation and connectivity across systems. By bringing together diverse technologies and expertise under larger umbrellas, these mergers and acquisitions pave the way for more robust customer support structures and foster an environment ripe for innovative breakthroughs.

Moreover, this can greatly simplify relationships between vendors and customers, offering more streamlined and integrated solutions. While it’s essential to maintain a balance and ensure customers retain the freedom to choose and integrate diverse technologies, the merging brings a unique advantage. It encourages the development of more seamless integrations and onboarding solutions through open APIs, promoting a more interconnected ecosystem. While underpinning the need for a centralised API source, this trend also opens up new avenues for R&D investments and new innovation resources in an ever-evolving market.

Conclusion

The comparison between the 2022 and 2024 infographics supports a growth, agility, and transformation narrative, illustrating an industry in motion where adaptability and innovation are crucial. As the landscape continues to evolve, it becomes increasingly evident that agility, innovation, and a keen understanding of emerging trends are essential for navigating the future of hospitality technology. This ongoing transformation is a story of technological advancement and a testament to the industry’s commitment to enhancing guest experiences and operational excellence in a digital era.

Comments are closed.