Record surge in international skiers drives tourism growth in Japan: Visa

Niseko, Hakuba and Furano within Japan are top ski destinations across Asia Pacific, as shown by cardholder spend

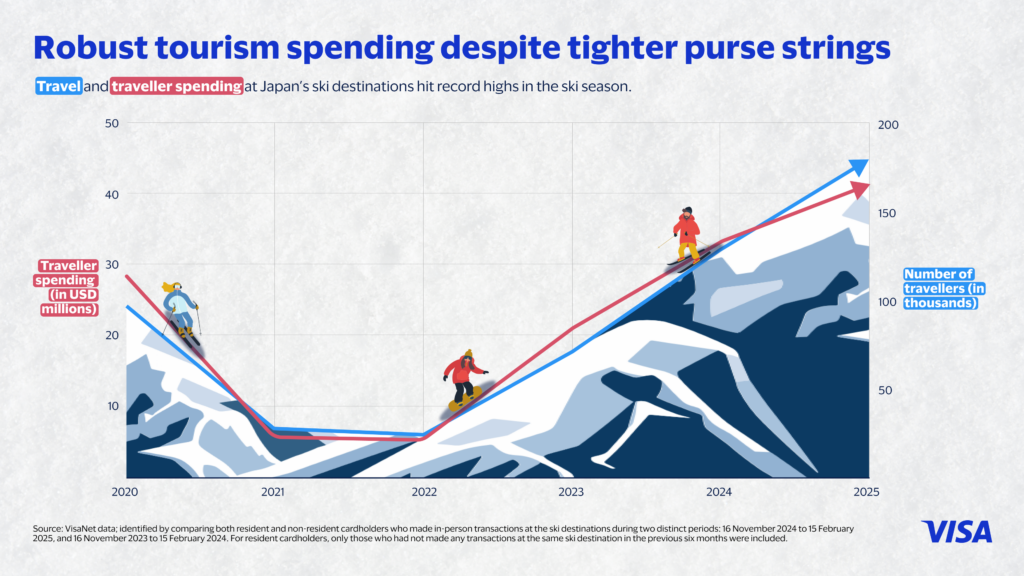

With peak ski season transforming to Spring blossoms, Visa revealed data showing growing popularity of Japan as a ski holiday destination among international travellers as number of visitors surpassed pre-pandemic levels, setting a fresh record.

Based on analysis of Visa cardholders’ spending patterns during the winter peak (November 2024 – February 2025) in the top ski destinations in Japan, the data shows around 40% year-on-year increase in number of domestic and international visitors as well as an uplift of about 25% in total spending. International visitors accounted for about 80% of total visitors and around 90% of total visitor spend.

Growing international allure of Japan as a ski destination

Visa data shows ski tourism in Japan is on the rise with the overall number of visitors having almost doubled compared to pre-pandemic levels.

- A popular ski destination for overseas travellers with international arrivals growing nearly 50% year-on-year, accounting for around 80% of all ski travellers during recent winter peak.

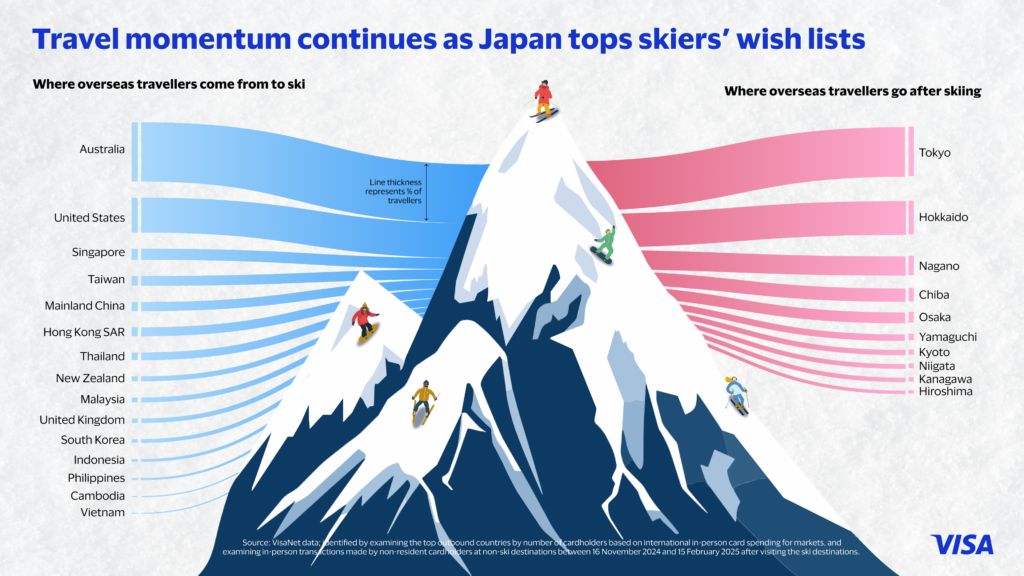

- A substantial influx of visitors from the region and beyond: Australia tops the list accounting for around 30% of total international visitors, followed by the United States (around 20%) and Southeast Asia, especially from Singapore, Thailand and Malaysia, collectively accounting for around 12%.

- Japan is now the preferred ski destination for Mainland Chinese travellers. For Australian travellers, Japan ranks second after New Zealand.

- Niseko and Hakuba remain top picks (nearly 50% and approximately 35%, respectively) for international ski travellers, while Furano is shown as a preferred destination for local visitors yet sees the fastest growth with around 70% year-on-year increase in overseas visits.

International travellers drive overall spend and venture beyond ski destinations

While on average domestic visitors show a slightly longer stay (about 5 days), international travellers spend more than 3 times as much per day, contributing to about 90% of overall spend. The uplift in spend is extended beyond ski destinations as international travellers continue their journey to other locations and spend in dining and retail shopping.

- Entertainment, lodging, and restaurants accounted for about 50 to 70 percent of spending by both overseas and local travellers.

- Ski resort experience spending takes up over 40% of overall spend by international travellers.

- Growing preference of contactless shown as they take up over 80% of total spend among international visitors. Nearly half of these transactions were mobile-based, showing a growth of about 30% from a year ago.

- Over 90% of overseas travellers extend trips beyond the slopes by an average of 9 extra days in Japan, driving around 35% more post-ski spending per day in cities like Tokyo, Osaka, and Chiba, with the bulk of post-ski spending being on shopping such as at department stores, discount stores, and for groceries (around 40% in total) and dining (around 20%).

Prateek Sanghi, Head of Visa Consulting and Analytics, Asia Pacific, said: “Our data not only indicates the growing appeal of Japan as a ski destination among international travellers but also can provide a powerful lens that can help better understand shifting travel and spending patterns of both domestic and overseas visitors. By leveraging data-driven consumer insights, governments and especially local businesses can better optimise their offerings, enhance traveller experiences, and modernise payment methods for the varying visitor segments.”

Visa’s payments data, consulting services and in-house data science capabilities enable organisations with key insights to help them enhance visitor experiences, optimise business strategies, and drive economic growth across the travel and commerce ecosystem.

Comments are closed.