The adage goes, “knowledge is power.” This is true for hoteliers who constantly face challenges keeping business afloat in the volatile hospitality industry. OTA Insight is a company that provides hoteliers with the tools that help them make informed revenue, marketing and distribution decisions.

TD has spoken with Amit Peshawaria, Head – Asia Pacific & Oceania at OTA Insight, about travel recovery and trends post-pandemic. Amit has an illustrious career in hospitality, which enables him to empathise with the pain points of the hotel commercial leaders he interacts with, especially the reporting consolidation that is needed to make crucial decisions. At OTA Insight, he solves customers’ problems through a customised approach using company tools.

Travel Daily (TD): Give me a bit of background about OTA Insight and your services. Why is the company still relevant in the post-pandemic era?

Amit Peshawaria (AP): We help hotels at pretty much every scale, from large regional and global chains, to independently run properties, enabling these hoteliers to make more informed room pricing and promotional decisions based on huge volumes of historic, current and forward-looking rate and demand data.

In turn, this saves them a lot of time, makes them more efficient and improves their bottom line. It also allows hoteliers to focus on what they enjoy and do best: providing an amazing guest experience to customers; a true win-win scenario.

OTA Insight started off as a single-product company – Rate Insight – providing real-time rate intelligence information on competitors, OTAs and Metasearch pricing strategies, to allow hoteliers to make smarter pricing decisions and maximise their revenue.

We have evolved to a more all-encompassing commercial platform for all hotel commercial teams who have a stake in revenue generation but are specifically geared to support a Revenue Manager.

Market Insight has the ability to predict demand evolution in your market. In such market unstable conditions, it’s particularly helpful and of great use to marketing teams as the location-specific, segmented demand insights facilitate more targeted campaigns. It helps to price your product against your static and dynamic comp set and keep an eye on your distribution across online channels so that you can monitor any rate leakage.

Through our business intelligence tool, Revenue Insight, you can analyse your business performance against a point in time (up to 3 years previous or 12 months ahead), providing a comparison of budget and forecast, and revealing the revenue potential of your PMS data.

In a post pandemic era, historical data is nowhere near as relevant as it once was. To maximise opportunity, while mitigating risk and the shortfall from the last two plus years, OTA Insight empowers hoteliers with the right tools to quickly analyse and act on the evolving landscape, to pivot their strategy where needed, and optimise their performance ahead of their competition.

TD: Speaking of the post-pandemic era, using data you garnered from your tools, can you give insights on travel recovery in APAC?

AP: There are obviously variations in the degree of recovery between different hospitality markets in APAC, considering the size and number of countries it makes up. However, there is a common trendline across almost all markets towards a more complete recovery.

A number of markets, such as Ho Chi Minh, Seoul, Singapore and Sydney, are already demonstrating a similar level of demand to that seen in 2019. At the time of this interview, our data shows that the following markets are seeing clear growth.

“The recovery is predominantly leisure driven…”

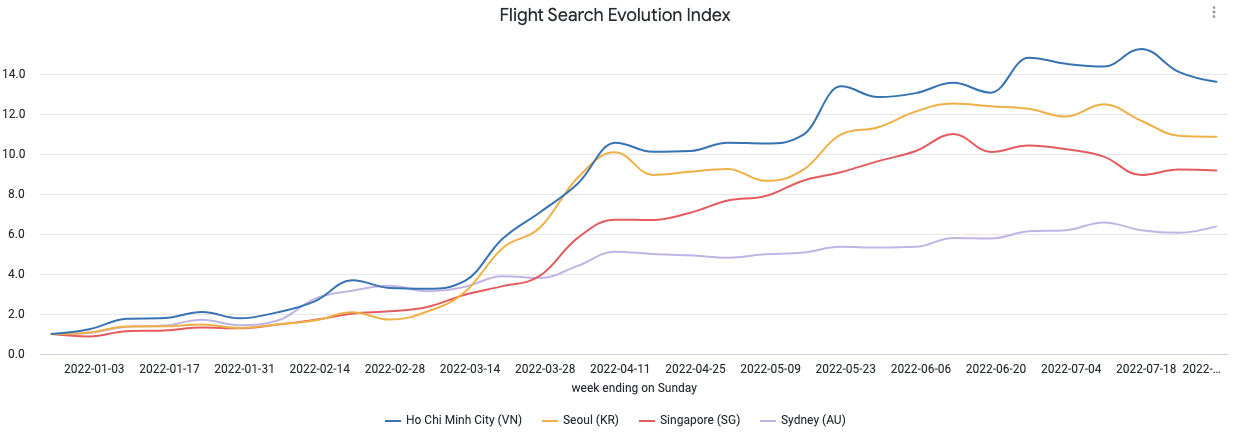

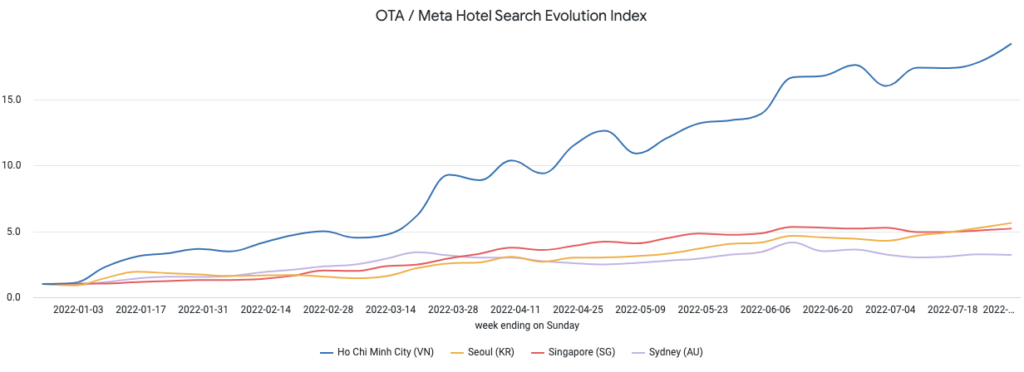

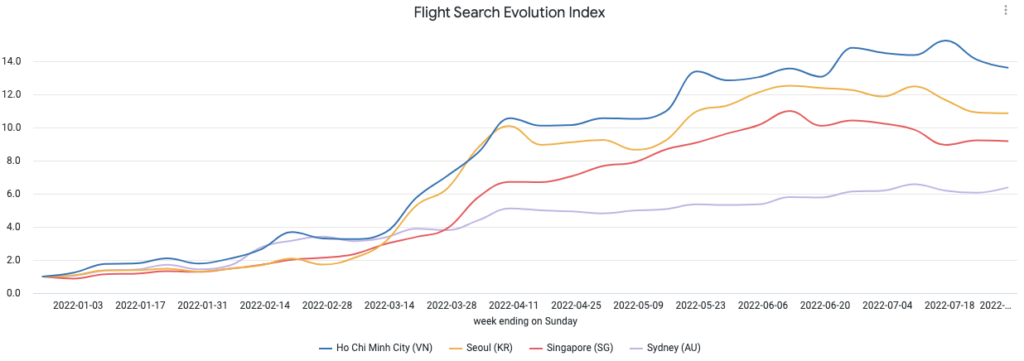

By examining OTA/Metasearch evolution in Market Insight from the start of the year until July 31st, we can see that Ho Chi Minh has the largest increase with 19.2 times the volume of searches compared to January this year, with Seoul at 5.6, Singapore 5.2 and Sydney 3.2.

Then looking at Flight Search Evolution in Market Insight, Ho Chi Minh has 13.6 times the volume of searches compared to January this year with Seoul at 10.8, Singapore 9.1 and Sydney 6.4.

The recovery is predominantly leisure driven, and with our predictive demand intelligence tool, Market Insight, you are able to analyse the new travellers searching for your market – which source market are they departing from, where are they looking, and for what length of stay. With these insights at your disposal, you can make more qualified commercial decisions.

Overall, the signs are positive for travel and hospitality in APAC. However, unstable geo-political events and a worrying economic outlook, featuring rising costs and high inflation, may still impact the markets to some degree. As hoteliers, it’s something to keep in mind.

TD: What are the travel trends you think we will see next year?

AP: As the hospitality sector transitions through the most significant event of our time and new travel trends begin to emerge, the proliferation of short-term rentals and their convergence with hotel accommodation looks set to stay. In an industry looking to rebound, the convergence of hotels and vacation rentals means that it is even more vital to understand the market and implement a comprehensive commercial strategy.

“Benchmarking is another hospitality trend which should become more prominent as it can help hotels in APAC successfully navigate the recovery and growth phase.”

Data insights that focus on just one or the other may not be able to provide the level of market intelligence needed to inform a complete commercial strategy. That’s why OTA Insight acquired Transparent in March of this year – a market-leading provider of data and business intelligence for the rapidly growing vacation rental industry.

Benchmarking is another hospitality trend which should become more prominent as it can help hotels in APAC successfully navigate the recovery and growth phase. In short, Benchmarking is the process of identifying and learning industry best practices and applying that knowledge to improve your business’ performance.

Competitive benchmarking, particularly around segmented market performance is vital today because it offers context around your performance, showing how your results compare against your compset, where you’re doing well, and areas you could improve upon. The right approach to hotel benchmarking, aided by leading hotel tech solutions, can help properties drive revenue and increase their profitability during, and after, recovery.

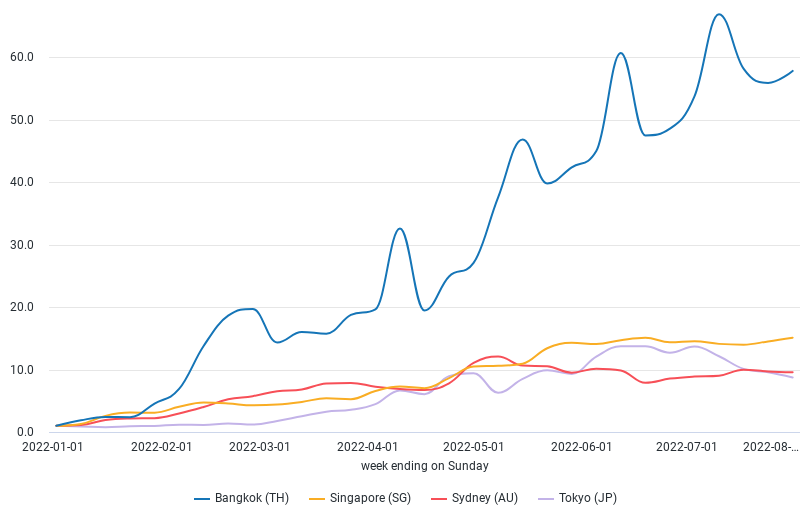

From our data, we can also see that corporate travel is making a gradual comeback in APAC. Not a full recovery just yet but there are encouraging signs. We are noticing more companies increasing their spending on business travel and allowing employees to travel internationally again. This is likely due to healthy corporate balance sheets and two years without meetings and events.

Taking a look at Global Distribution System (GDS) searches in Market Insight, which gives a good indication of the state of corporate travel – if we compare now to the start of the year for some of APAC’s leading commercial centres, there has been a marked growth in the first half of the year. By the 31st of July, Bangkok saw GDS search volume rise 57.8 fold since January 1st; Singapore at 15.1, Sydney 9.6, and Tokyo 8.7.

Finally, we are currently also observing a high volume of hotel acquisitions, sales and brand mergers taking place, which doesn’t appear to be slowing down anytime soon. Corporate teams will need to fully optimise performance across previously disparate properties. Therefore, the implementation of tools capable of enterprise reporting that can consolidate data from multiple property management systems will become far more prevalent among commercial leaders.

TD: What is next for OTA Insight? How will you get there?

AP: It’s been a tough few years for the hospitality industry, ourselves included. Throughout this time we have done our utmost to provide the best possible service to our customers – that’s something we will always maintain.

As a company we pride ourselves on the quality of our solutions and the data we deliver to hoteliers. With that, we will continue to innovate, and develop our technology and datasets, so that each hotel commercial team uses OTA Insight’s platform as a one-stop-shop for everything revenue related.

Moving forward, we have an ambitious international growth strategy. In November 2021 we raised $80 million from Spectrum Equity, a leading growth equity firm. This has assisted in the acquisition of Transparent (as mentioned above) and Kriya RevGen, a leading hotel revenue intelligence platform that simplifies and streamlines data collection, analysis, and reporting to optimise performance across groups of hotels. In combination with a number of valuable new partnerships, including Tripla, RMS cloud and PredictHQ, these recent acquisitions further strengthen our market position.

As part of our growth strategy, we are also expanding our team considerably. Our offices in Singapore and Australia are open once again and we are on the lookout for great talent to fill some new positions in APAC. Please take a look at our careers page if you are interested in joining a dynamic team.