Cross-border selling to and from China: Larry You, Westwin

Contributors are not employed, compensated or governed by TDM, opinions and statements are from the contributor directly

Recently Westwin, a digital marketing and consulting firm that focuses on cross-border business in and out of China, released a fascinating report on the purchasing behaviour of Chinese outbound tourists. For this week’s podcast, I caught up with Larry You, the marketing manager of Westwin for overseas businesses, to learn more.

Recently Westwin, a digital marketing and consulting firm that focuses on cross-border business in and out of China, released a fascinating report on the purchasing behaviour of Chinese outbound tourists. For this week’s podcast, I caught up with Larry You, the marketing manager of Westwin for overseas businesses, to learn more.

The following is an abridged version of that conversation. You speaks:

Westwin’s background

Westwin provides brand strategies and digital marketing solutions to help clients achieve success in China and globally, formerly known as MSN China until 2004. We help our clients with online marketing; in 2010 we launched Bing ads in China to help Chinese companies such as Alibaba and jd.com to achieve success abroad. In 2016 through a management buyout the company was renamed as Westwin.

Right now we are partnering with Chinese search engines and social platforms to offer foreign brands China-dedicated marketing and advertising solutions.

On one hand we are helping national brands to come to China, and helping them with brand exposure and presence; on the other hand, we are helping Chinese companies to go abroad to do the same thing.

The report

A number of successful companies have failed in China: 10 or 15 years ago, in the early age of cross-border business, foreign companies trying to come to China were making a lot of mistakes.

It became a huge lesson and learning experience – especially for companies nowadays. I think the real wave of companies going abroad started in the last two or three years; both global and Chinese companies are learning a lot from the earlier mistakes made by those foreign companies.

Digital trends in China

Chinese consumers are tech savvy and are using their mobile phones all the time. You have to keep up with trends and you have to know what’s going on in the ‘digital jungle’.

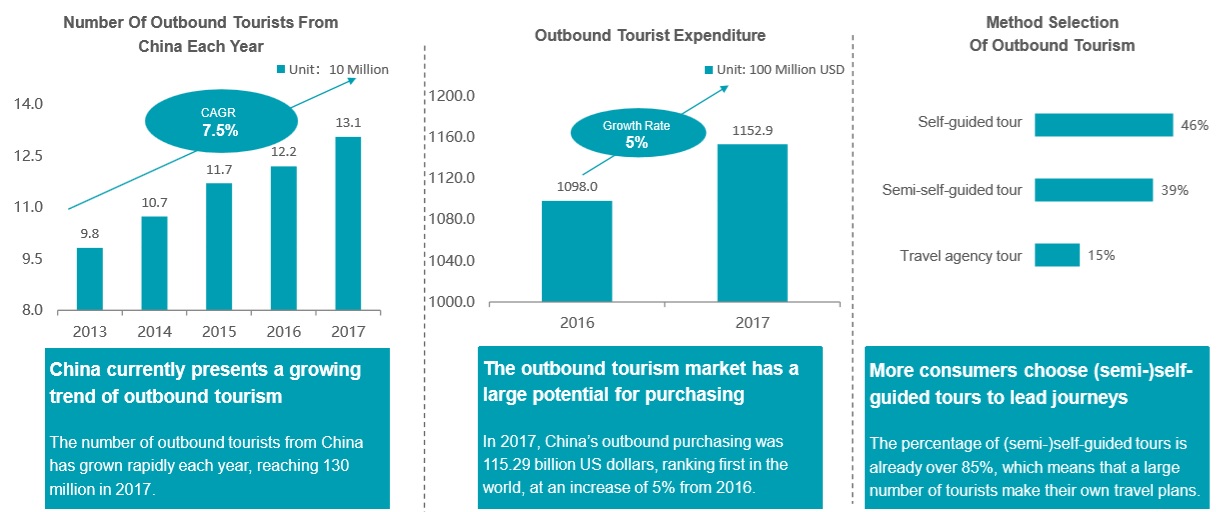

There are three key trends in outbound tourism; first, the numbers and growth. The number of outbound Chinese tourists has grown rapidly to 130 million. Keep in mind that this is not just about the travellers but the consumers: in 2017, China’s

outbound purchasing reached USD 115 billion – the highest number in the world. That’s a 5% increase from 2016.

[The report shows 7.5% growth – this is 7.5% growth on 130 million people; almost 10 million new travellers are entering the space every year]

[The report shows 7.5% growth – this is 7.5% growth on 130 million people; almost 10 million new travellers are entering the space every year]

Travel type

Second is type of travel. Now, more customers are choosing a self-guided tour or semi-self-guided tour compared to a travel agency tour, which were more popular 5 or 10 years ago. ‘Semi-self-guided’ means a mix of self-guided and agency travel; for example, I book the air ticket and hotel by myself, but when I arrive at the hotel I sign up for a guided tour.

85% of the outbound traveller volume is self-guided or semi self-guided. Only 15% is being reported as guided or managed tours.

Chinese tourists themselves are changing. Before, there were more senior citizens who had a language barrier so they were more reliant on the travel agencies. These days, Chinese tourists are younger and more educated so the language barrier has gone.

“A golden opportunity for tour operators”

Nowadays, Chinese people also have easy access to more information so they can do their homework and plan the trip themselves, for example via social media.

Scenic spots in Europe used to be famous for being filled with Chinese tourists, but this stereotype is gone and replaced by individual Chinese travellers who are spending a lot of money on food, hotels and souvenirs – this is a golden opportunity for tour operators.

Capturing the market

Japan, Korea, and the United States are the top key markets these days; plus Australia, United Kingdom Singapore and Canada are also drawing a lot of attention for outbound tourism.

The average traveller is no longer a senior citizen. From our research, they are aged 35 to 44 – they are younger than you might think. They are spending more; the average expenditure for an outbound tourists in the past 12 months is RMB 20000 or about USD 3000.

The average traveller is no longer a senior citizen. From our research, they are aged 35 to 44 – they are younger than you might think. They are spending more; the average expenditure for an outbound tourists in the past 12 months is RMB 20000 or about USD 3000.

Tourists with children are spending more than those without children, so, if your brand is targeting families and young parents there are a lot of marketing opportunities.

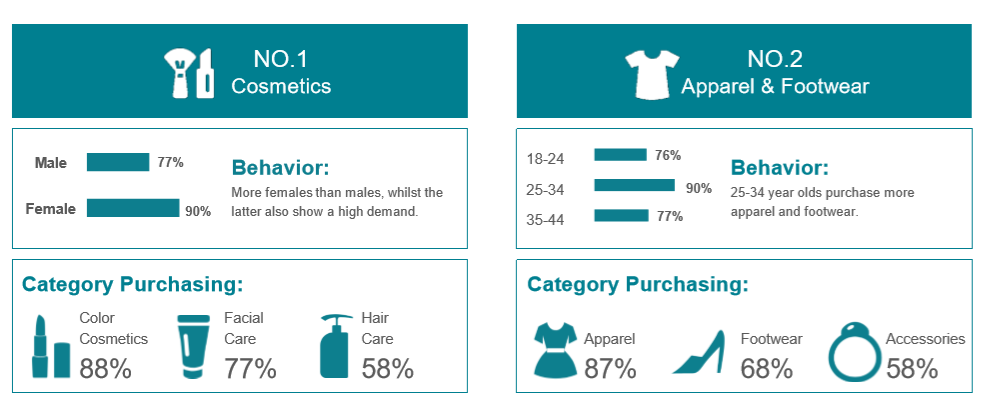

Female travellers are spending more and the most popular items are cosmetics, apparel and footwear. Also, females make up the vast majority of frequent travellers. With the change of lifestyle, more females are embracing travel around the world.

However, men also buy a lot of cosmetics, perhaps for their families or loved ones.

If I am going abroad, my colleagues and my family will know and they will say, ‘Can you buy me some souvenirs?’. I have a shopping list of gifts for my parents, for my girlfriend for my colleagues. I’m going there with a mission to shop.

Payment methods

Before, we always assumed Chinese outbound tourists were paying with cash or credit card. According to our report bank cards are still very important at 77%; however, mobile payment options Alipay and WeChat are very strong. 69% of tourists chose to use Alipay when abroad and WeChat Pay accounted for 46%.

These payment apps are easy and really popular, especially in first tier and second tier cities. These are widely accepted; you can go out in China and not need any cash – make sure you have phone battery and you’re covered.

“Even though I have cash when I travel, it helps to use WeChat pay”

Furthermore, these apps are becoming very popular in the ‘famous cities’ for travellers, such as New York, Sydney, Bangkok and Singapore. In Bangkok every 7-Eleven accepts WeChat pay. Even though I have cash when I travel, it helps to use WeChat pay as it’s connected to my bank account at home.

Singapore Changi airport has WeChat Pay in every store so that’s good news for Chinese consumers and better news for the airport itself.

Payment tools as media providers

‘Scan the QR code and pay’ is the main function for these payment apps, but they can do more than that. Let’s say you want to go to New York City and you want to pay with Alipay. You open the app to pay and it also shows more information about the neighbourhood – a bit like TripAdvisor.

You can find great restaurants, shops and coffee houses around the area. Other users can share their experiences so you can not only pay but find information around you -which can trigger consumption.

The main source of information, for outbound travel, are e-commerce platforms, search engines and social media. And they are all domestic platforms, for example Weibo and WeChat, which have become important to search for information overseas. You might assume that they would use local platforms like Yelp or TripAdvisor but [we prefer to use] the Chinese platforms that we are used to. Indeed, TripAdvisor only has 5% of market share.

Crip is no doubt the number one for travel information and you can do this pre-booking so it operates more like an OTA. Fliggy is becoming more popular; it was launched by Alibaba, and Alipay is of course helping their business. These channels are very effective if you want to look into a marketing campaign or advertising as the average Chinese tourist is very mobile-centric.

Denping-Meituan is also very popular. It started as a restaurant recommendation platform, similar to Yelp. As its popularity increased it grew from restaurants to hotels, to shops and bars, and now tourism.

“You are almost definitely going to use Denping”

If you go to a new city and you are looking for a famous place to visit, you are almost definitely going to use Denping. You can see other people’s comments, with pictures and videos, and now Denping is working with the merchants to provide Groupon-style deals. That was mainly in China but is now growing to foreign countries such as London Sydney, and New York.

You can find restaurant listings, recommendations and comments from similar Chinese tourists. This is a really smart channel for local businesses to market themselves to Chinese people digitally, and to convert them from just a viewer to a purchaser.

Converting to purchase

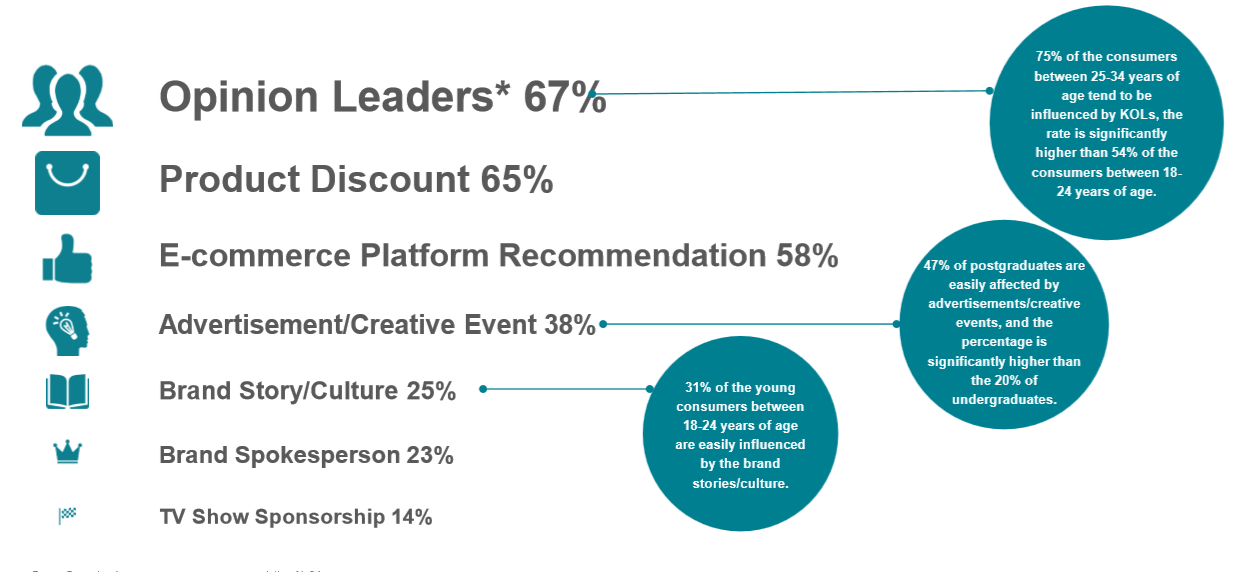

The main drivers to purchase are opinion leaders – friends, relatives, colleagues, or KOLs (Key Opinion Leaders) such as internet celebrities – who take 61% of market share.

The main drivers to purchase are opinion leaders – friends, relatives, colleagues, or KOLs (Key Opinion Leaders) such as internet celebrities – who take 61% of market share.

The next is discounts at 54%; we had assumed that this was the key reason for outbound tourists to buy. Third is brand story or brand culture, at 42%. This is particularly attractive for cross-border tourists and overseas residents.

“If your brand has a great story or culture make sure that you translate it into Chinese”

This is also for individuals with a higher education who play attention to the cultural creativity of a certain product. If your brand has a great story or culture, make sure that you translate it into Chinese and make full use of it.

Social commerce

Get your story out via Chinese social media platforms. The two giants, Weibo and WeChat, are not just social platforms for people to contact each other, but they are a great way to search for a product or brand information even for overseas companies. We check Weibo with a very high frequency so if you’re present there, there’s no way we can miss it.

Chinese consumers want to see real opinions and want to see how these places interact with people. Chinese people are still highly reliant on the word of mouth and the opinions of fellow Chinese tourists. Let’s say we go to a restaurant in London; even though it’s widely popular for London citizens, Chinese visitors feel like they have a link to other fellow Chinese tourists so we rely on their opinion.

Social commerce is simply e-commerce with a social flavour. If you see a brand talking about their product on WeChat, it’s just one click to the e-commerce platform, also within WeChat. It’s useful for brand presence and popularity but also you can change them from a follower to a consumer.

Conclusion

The report has a lot of interesting themes if you are looking to target Chinese travellers; especially buying habits and age groups, and preferred advertising platforms.

“Find your tone and have the localisation mindset”

Above all, if you want to win this market, you have to keep up with digital trends including social advertising. Our company is trying to help with localisation which is very important for brands and Chinese travellers. Make sure you find your tone and have the localisation mindset; that will be the key for success.

Comments are closed.