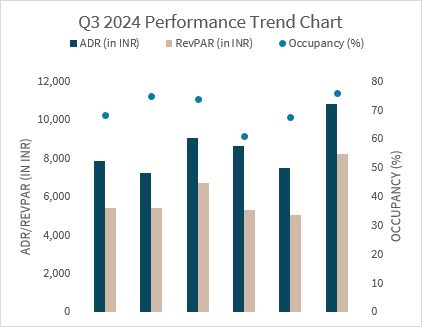

The hospitality sector continued to witness Year-on-Year (YoY) growth in performance in Q3 2024 (July – September 2024), primarily driven by a rise in Average Daily Rate (ADR), resulting in a RevPAR growth of 10.8%. In terms of quarterly growth, the sector continued to mark its ascendancy, registering a positive RevPAR growth of 2% Q-o-Q in Q3 2024, compared to Q2 2024. This can be attributed to the typical nature of the third quarter of the year witnessing higher corporate travel as compared to the second quarter, according to JLL’s Hotel Momentum India (HMI) Q3, 2024.

Apart from a slight decrease in the average daily rate (ADR) of Delhi and Goa, all other major markets (Bengaluru, Chennai, Delhi, Hyderabad, and Mumbai) showed considerable growth in ADR and revenue per available room figures, with Hyderabad leading the list. Although occupancy levels remained relatively stable across the board in Q3 2024 compared to Q3 2023, ADR levels improved, leading to an increase in RevPAR across all major markets.

The upcoming quarter is anticipated to benefit from the continued resurgence of corporate travel, festivals, and other corporate and social Meetings, Incentives, Conferences, and Exhibitions (MICE). The industry’s strong momentum and sustained domestic demand for business travel, as well as corporate and social MICE events, will drive a busy season.

In Q3 2024, there were 96 branded hotel signings comprising 10,686 rooms. Furthermore, 12 hotels signed were conversions of other hotels, accounting for 11% of the inventory signed in Q3 2024. Branded hotel openings comprised 30 hotels with 1,988 keys, of which approximately 80% of the total number of keys were located in Tier II and III cities, including Tirupati, Udaipur, Ranchi, and Mussoorie to name a few.

Hyderabad emerged as the RevPAR growth leader in Q3 2024 registering a growth of 23.6% over Q3 2023, followed by Chennai and Mumbai with YoY growth of 17.7% and 16.8% respectively.

“Backed by strong performance of hotels across India, we continue to see investors moving money in this asset class. There is strong momentum on both greenfield developments as well as operating assets across business and leisure markets. Although the summer season has brought down corporate room night demand in Q3 2024, the sector continued to demonstrate growth in average daily rates (ADR) compared to Q3 2023. Looking ahead, the sector’s performance in the upcoming quarter appears promising due to the festival season, general rise in domestic corporate travel, the strengthening of MICE events, weddings, and other social gatherings”, said Jaideep Dang, Managing Director, Hotels and Hospitality Group, India, JLL.

Comments are closed.