COVID-19 cancels more than 200,000 flights to, from and within China

Contributors are not employed, compensated or governed by TDM, opinions and statements are from the contributor directly

Over 200,000 flights have now been cancelled or proactively removed from schedules to, from and within China due to COVID-19 (coronavirus), according to Cirium.

The figure – which accounts for over two-thirds of China’s originally scheduled flights – dates from when the authorities restricted travel in and out of Wuhan Tianhe International Airport on 23 January to 18 February.

As the virus transmission and infection rates rise, airlines are increasingly cancelling flights.

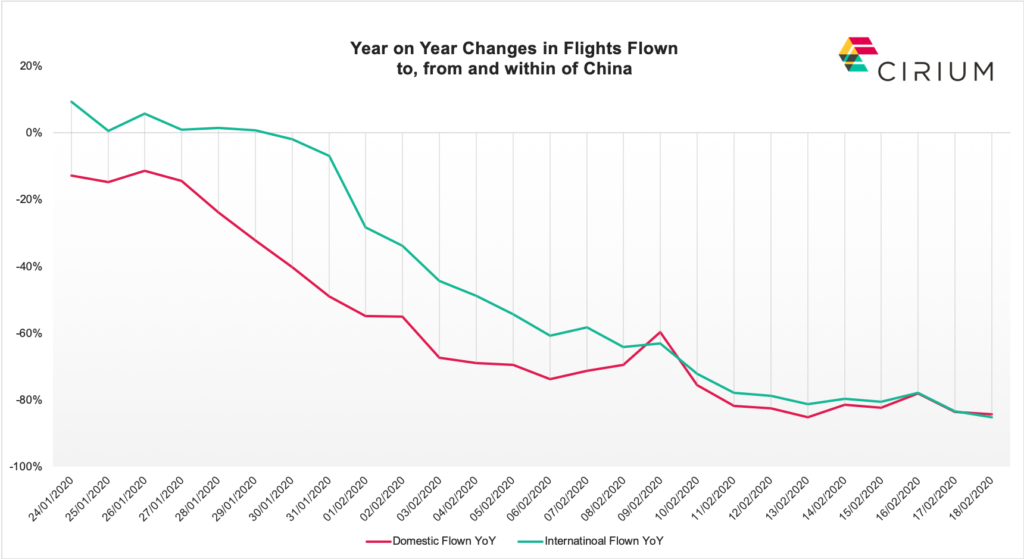

A total of 99,254 flights have not flown against the adjusted schedule between January 23 and February 18 with domestic flights accounting for 89% of that figure. However, Cirium data shows more international carriers are now cancelling flights, particularly those linking to Greater China.

Between January 23 and January 28, 2020, the number of flights not flown totalled 9,807 with only domestic services affected at that stage. The unprecedented increase since then highlights the speed at which airlines have acted to help contain the outbreak.

As well as flights being cancelled or not flown, Cirium’s analysis also shows airlines proactively removing flights from their future schedules.

Richard Evans, senior consultant at Ascend by Cirium, said: “The International Air Transport Association (IATA) had originally predicted global airline capacity to grow by 4.7% in 2020, but in the current uncertain dynamic, are issuing revised guidance which indicates stagnation or slight contraction of the global market in 2020.

“For the first eight weeks of the year, Cirium’s schedules data shows that global capacity fell by 0.9% compared to 2019. The next two weeks showing a continuing fall of around 10% year-on-year, led by Chinese airlines having removed over 60% of their scheduled flights.

“We are also now seeing impact outside of China. Countries with the biggest exposure to outbound Chinese leisure travellers, such as Thailand, Singapore, Vietnam and Cambodia have seen schedules cut by 70% or more on services to China and are starting to see further reductions on non-Chinese routes. This will inevitably be hurting sectors focused on the tourist economy, including airlines.”

Cirium predicts that the impact of the COVID-19 outbreak is expected to have a serious short to medium term effect on demand, airport and airline finances. While its analysis demonstrates that it is impossible to anticipate the IATA forecast for traffic, revenues and costs, it is likely that a drop will be seen which may have a knock-on effect on global GDP growth.

To put this in perspective, Cirium’s data shows that the number of flights actually flown to, from and within China are down over 80% against 2019 when compared to the schedule that was originally planned for February 2020.

Hong Kong is also seeing large schedule cuts, with flights flown down over 60% this week.

The top three most affected airlines between 23 January and 18 February by percentage of flights not flown against the adjusted schedule are: Lucky Air, with 48.8% of flights not flown accounting for 2,371 flights out of a scheduled 4,857; China Southern Airlines, with 46.2% of flights not flown accounting for 20,441 out of 44,274 flights; and Xiamen Airlines, with 43.8% of flights not flown, accounting for 6,341 flights out of the 14,495 scheduled.

As expected, Wuhan Tianhe International Airport is the airport most heavily affected by the COVID-19 viral outbreak, with 94% of outbound and inbound flights cancelled against the adjusted schedule (a total of 3443 flights not flown in the time period), according to the analysis.

Others airports most affected after Wuhan are: Urumqi Diwopu International Airport (URC), with 4,506 flights cancelled; Guiyang Longdongbao International Airport (KWE), with 4,321 flights not flown; Changsha Huanghua Airport (CSX), with 4,757 flights not flown; and Hangzhou Xiaoshan International Airport (HGH), with 6,084 flights not flown, are the most impacted airports.

Recently, airlines in the US have followed the example of UK carriers British Airways and Virgin Atlantic and have started cancelling flights. For example, American Airlines has now cancelled 60% of its scheduled flights in and out of China, United Airlines has cancelled 19% and Delta has cancelled 18% of scheduled flights, between January 23 and February 18.

As a result, the most heavily affected routes between the US and China are Dallas/Fort Worth International Airport (DFW) to and from Beijing Capital International Airport (PEK), Wuhan to San Francisco International Airport (SFO), and Dallas to Shanghai Pudong International Airport (PVG) by percentage of flights not flown by route.

Evans added: “It’s difficult to comment on the anticipated recovery of the aviation industry off the back of the outbreak, as the number of cases is still increasing currently and as the data shows more airlines are cancelling and removing flights from schedules.

“The first step is to see a clear and sustained fall in the number of new COVID-19 cases, however, we do expect a strong recovery once the virus is successfully combatted. The SARS experience in 2003 showed us that within six months post-outbreak, passenger traffic growth had recovered and 2004 saw double-digit growth.”

Comments are closed.