How embedded protection can benefit customers and provide additional revenue for travel providers

Contributors are not employed, compensated or governed by TDM, opinions and statements are from the contributor directly

Global air travel has resumed after years of slowed activity, and people are excited about getting back to the skies. Overall traveller numbers are expected to reach 4.0 billion in 2024, exceeding pre-COVID-19 levels, and within Asia Pacific (APAC), travel is expected to rebound swiftly, with travel search volume increasing 50% in Q4 2022 year over year.

However, after reducing staffing due to the prolonged languish in travel demand, airports and airlines are now struggling to keep pace with the resurgence. Since the summer of 2022, we have seen airports and airlines in Europe fail at keeping up with the growing demand, leading to poor customer experiences and spikes in flight cancellations and delays.

Travellers are unhappy with flight delays and cancellations

In Australia, for when the fiscal year ended June 2022, on-time arrivals for airlines averaged only 77%, while departures came in at 76% and the cancellation rate for the year was 8.3%.

Flight delays and cancellations will no doubt result in increased claims volume, which inadvertently leads to longer wait times and poor Net Promoter Scores (NPS), which have historically plagued the airline industry. In 2020, airlines reported an average NPS of -1 — 13 points lower than the average across all sectors.

Nonetheless, despite lowered customer satisfaction, the travel industry is still expected to be on track to return to profitability in 2023, as they continue to cut losses stemming from the effects of the COVID-19 pandemic to their business in 2022.

Travel providers can boost traveller confidence with embedded protection

With reports of flight delays, cancellations and lost baggage clamouring for media attention, airlines are bearing the brunt of traveller frustration and anger. However, there are options readily available to help travellers manage their travel risks.

Trip protection isn’t new to travellers, but now, more are increasingly seeking protection from their favourite travel brands to safeguard their interests. According to the Embedded Insurance Travel Report conducted by Momentive.ai and commissioned by Cover Genius, 45% of global travellers would prefer to buy protection directly from their travel provider, agent or airline.

This insight should encourage travel providers to become intermediary agents to address any protection gap travellers face — especially with the option of providing customers with ‘Cancel For Any Reason’ (CFAR) protection. CFAR enables travellers to book their airfare with the freedom of knowing they will receive a full refund if they need to scrap their plans for any reason — from illness to public transport disruption to extreme weather.

In anticipation of better resourcing and operations planned for the surge in demand, travel operators can also leverage embedded protection to offer their customers bespoke solutions that can get in front of these challenges. Providing travellers with relevant protection at the time of booking can also generate an additional ancillary revenue stream for their businesses. As airlines grapple with lost and delayed bags, adding a simple baggage protection or flight delay option for customers can ensure travellers are automatically compensated should there be any baggage delay or mishaps.

By offering your customers embedded protection during the booking process, you also eradicate the dreaded second step of finding and purchasing third-party travel insurance after buying airfare.

Tailored, end-to-end solutions that meet traveller needs and unlock revenue

Cover Genius has been co-creating embedded protection solutions with its travel partners when traditional insurers went missing and left travellers unprotected in times of need, and with travel demand rising faster than ever now, it is even more important to stay ahead of the curve.

In-demand solutions, like CFAR protection, not only allow airlines and travel agents to build rapport with travellers, it can also open up a stream of ancillary revenue. Additionally, travel providers and airlines can minimise any payment liabilities by providing refunds in the form of flight credits or miles.

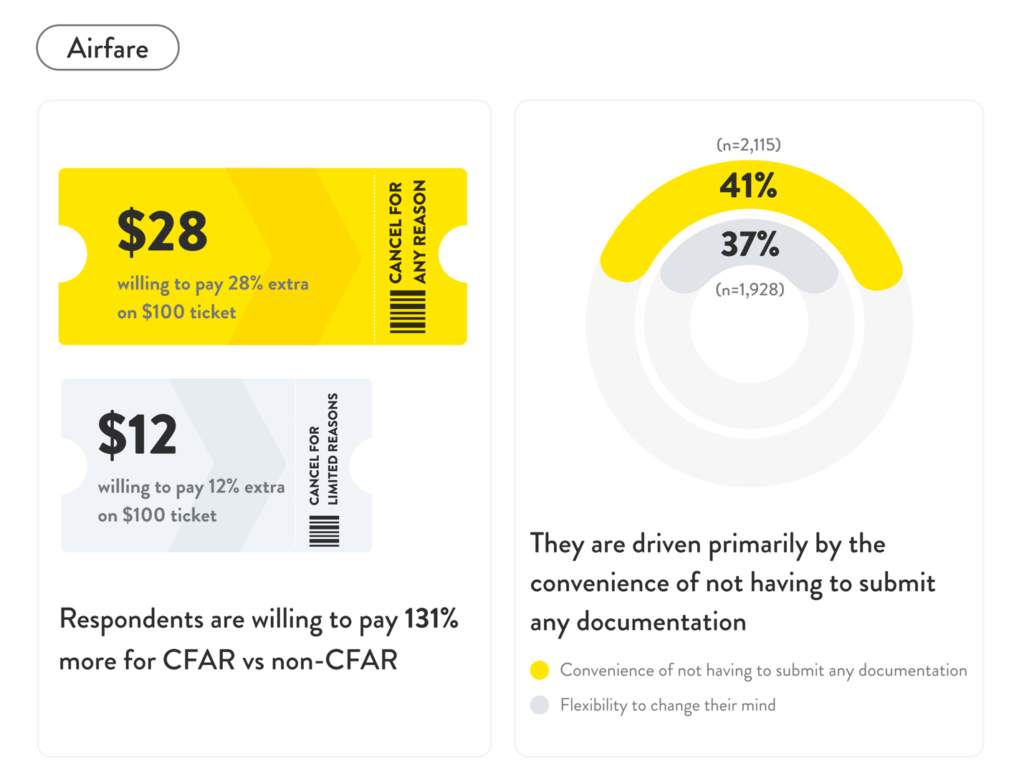

In the Refund Protection Report, where over 10,000 global consumers were surveyed across eight countries, 60% of travellers said they’d be highly likely to book airfare when given the option to purchase CFAR protection, as opposed to non-CFAR protection which would require them to submit paperwork or documentation. Driven primarily by convenience, they are also willing to pay 133% more for CFAR protection than non-CFAR protection.

When it comes to travel protection, the end-to-end customer experience is just as important as the policies themselves, and travel providers should be proactive in facilitating a frictionless claims process. With instant payments of approved claims in more than 90 currencies through a wide range of payment methods, Cover Genius’ XCover.com platform has landed an industry-leading NPS of +65‡. Additionally, its award-winning service design has helped Cover Genius’ partners achieve a 7x reduction in support tickets.

‡ The score includes any type of claim and claim outcome across our partner network except for those partners with less than 30 claims and those not assessed by Cover Genius.

Comments are closed.